Best 7 Installment Payment and Buy Now Pay Later (BNPL) Software products

What is Installment Payment and Buy Now Pay Later (BNPL) Software?

Installment payment and BNPL software lets customers split purchases into smaller payments over time, making big buys more affordable. It’s a financing option integrated at checkout to boost conversions and customer satisfaction.

What are the top 10 Commerce Software products for Installment Payment and Buy Now Pay Later (BNPL) Software?

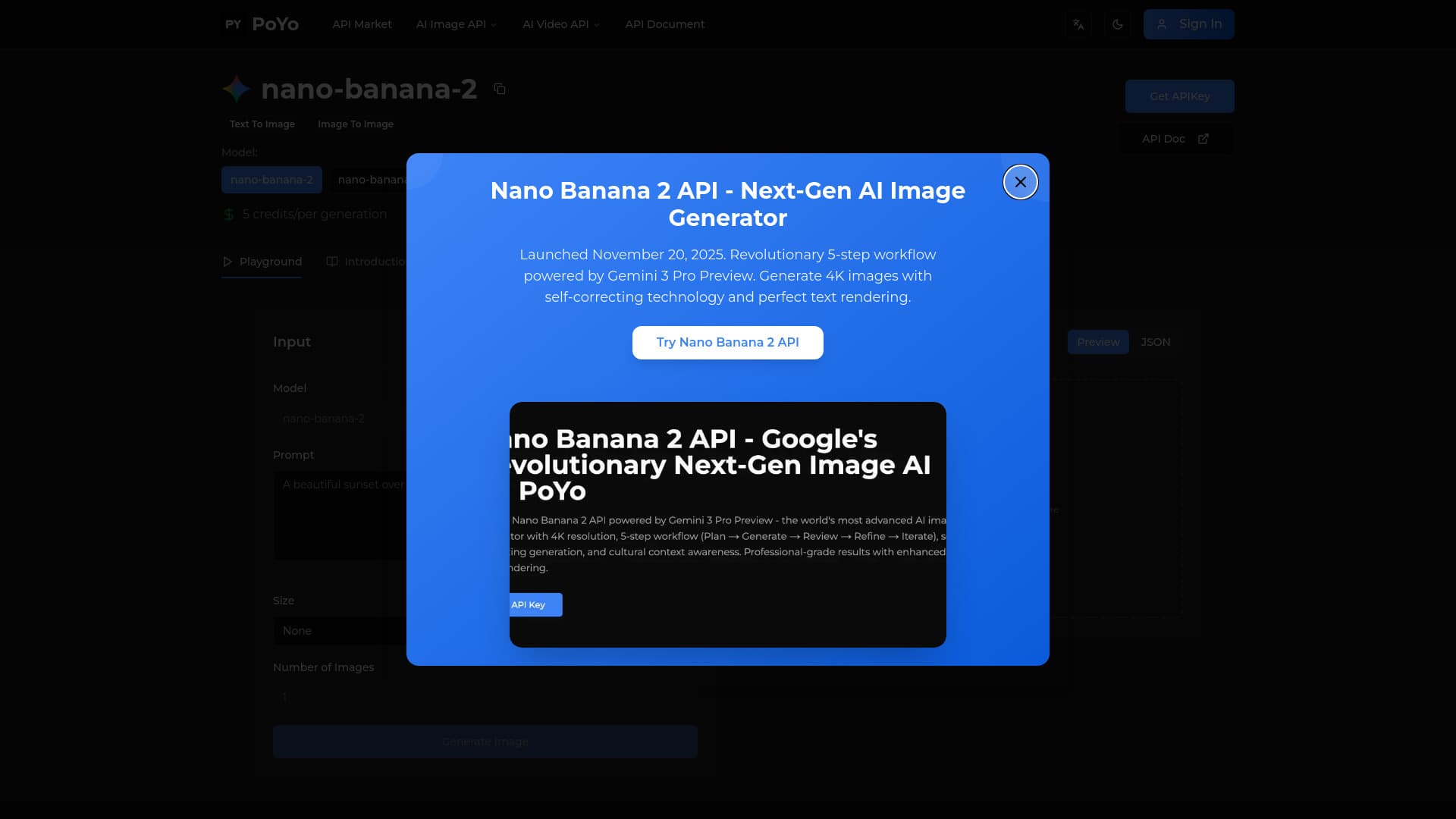

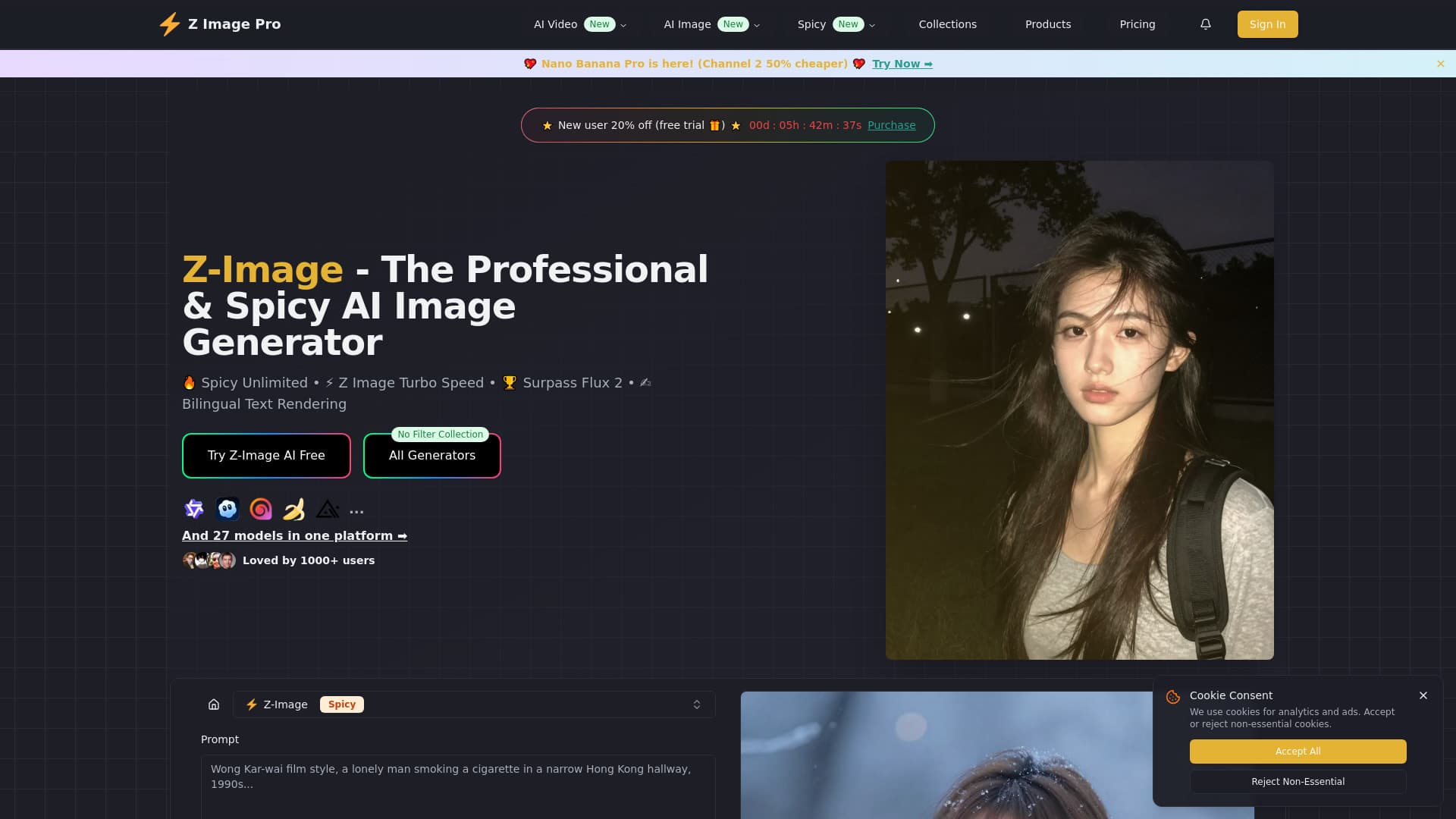

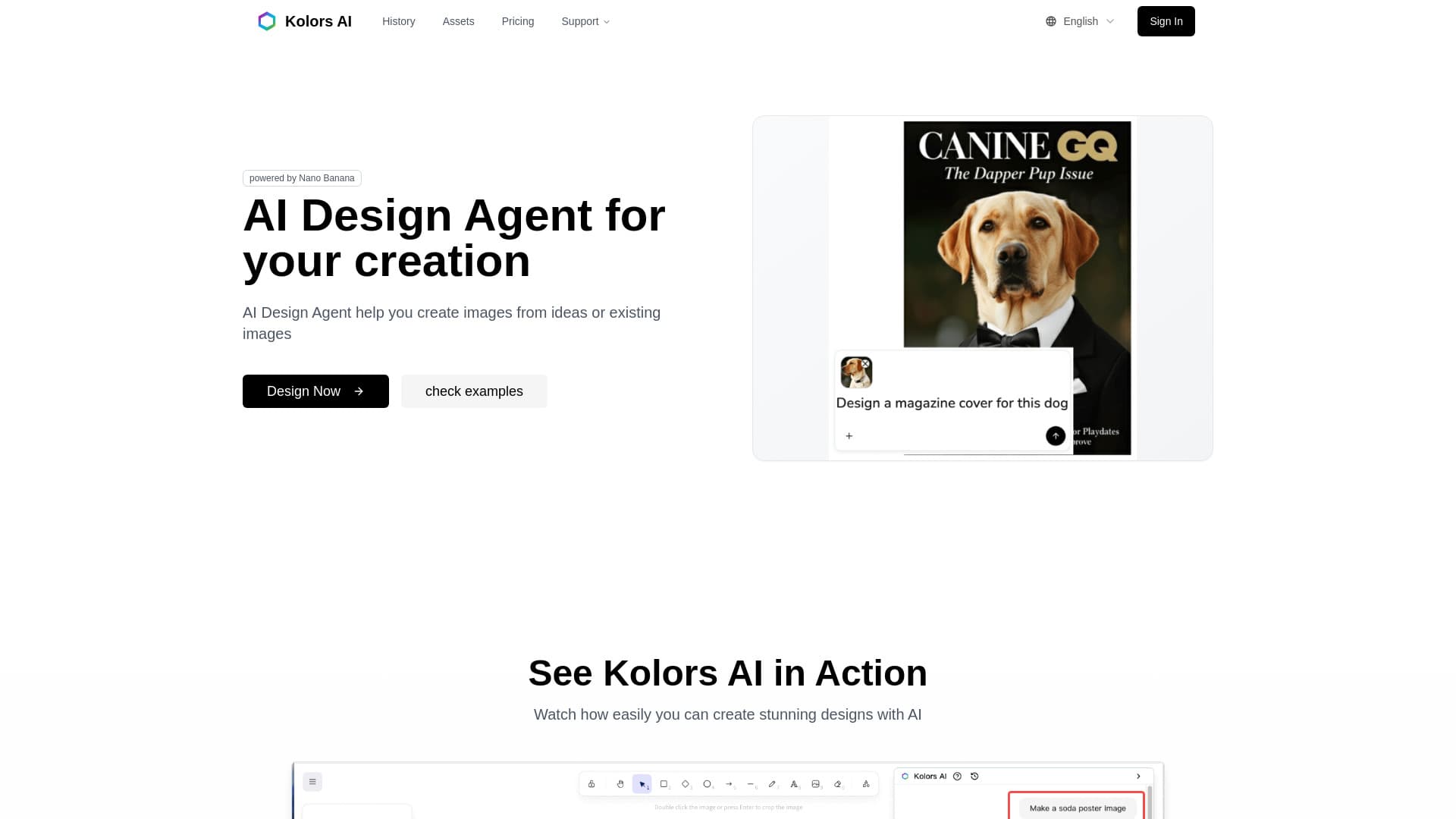

Newest Installment Payment and Buy Now Pay Later (BNPL) Software Products

Installment Payment and Buy Now Pay Later (BNPL) Software Core Features

- Flexible payment schedules

- Instant approval process

- Integration with e-commerce platforms

- Interest and fee management

- Customer credit checks

Advantages of Installment Payment and Buy Now Pay Later (BNPL) Software?

- Increases average order value

- Makes purchases more accessible

- Reduces cart abandonment

- Provides flexible payment choices

- Enhances customer loyalty

Who is suitable to use Installment Payment and Buy Now Pay Later (BNPL) Software?

Retailers, online stores, and businesses wanting to offer flexible financing options to customers.

How does Installment Payment and Buy Now Pay Later (BNPL) Software work?

At checkout, customers choose BNPL or installment plans as payment methods. The software evaluates eligibility, approves instantly in most cases, and splits the total cost into payments. The software handles billing and payment collection while merchants get paid upfront or per agreed terms.

FAQ about Installment Payment and Buy Now Pay Later (BNPL) Software?

What's the difference between installment payments and BNPL?

BNPL usually offers interest-free short-term payments, while installment plans can be longer and may include interest.

Do customers need good credit to use BNPL?

Many BNPL providers have lenient credit checks, but it varies by service.

Who bears the risk if a customer doesn't pay?

Typically the BNPL provider assumes the risk, paying the merchant upfront.

Are there fees for merchants to offer BNPL?

Yes, merchants usually pay a transaction fee or commission to BNPL providers.

Can BNPL increase sales?

Yes, it often boosts conversion rates and average purchase amounts.